Welcome to the 5th edition of my exclusive Tiny Titans behind-the-scenes newsletter.

Last week, I shared some information about The Best Stock Ever.

Today, I’ll help you determine whether Tiny Titans is something for you.

Make sure you don't miss it. Put the launch of Tiny Titans in your calendar here.Since I launched this exclusive behind-the-scenes newsletter, I’ve been asked the same question over and over:

How can I decide whether Tiny Titans is something for me?

Let me be honest with you.

Tiny Titans is not for everyone. It’s not for people who want to:

❌ Get rich quick

❌ Can’t stand high volatility

❌ Outperform the market every single year

The stocks I will talk about have tremendous upside potential, but are also riskier than the ones I write about at Compounding Quality.

Some of the stocks I recommend may be down 30% or more.

If you don’t like this, please unsubscribe from this behind-the-scenes newsletter right away.

To me, it’s no problem that some of these stocks decline heavily.

The goal is to find small companies with the potential to become large ones over time.

Here are a few examples:

Pool Corporation ($POOL) increased from $0.92 in 1995 to $307 today

Constellation Software ($CSU) increased by almost 30,000% since 2006

Watsco ($WSO) went from $3 in 1985 to $454 today

Medpace ($MEDP) increased by 1,000% since 2016

You only need a few stocks like this during your entire career to be very successful.

What’s the investment philosophy?

For Tiny Titans, the same philosophy as for Compounding Quality will be used.

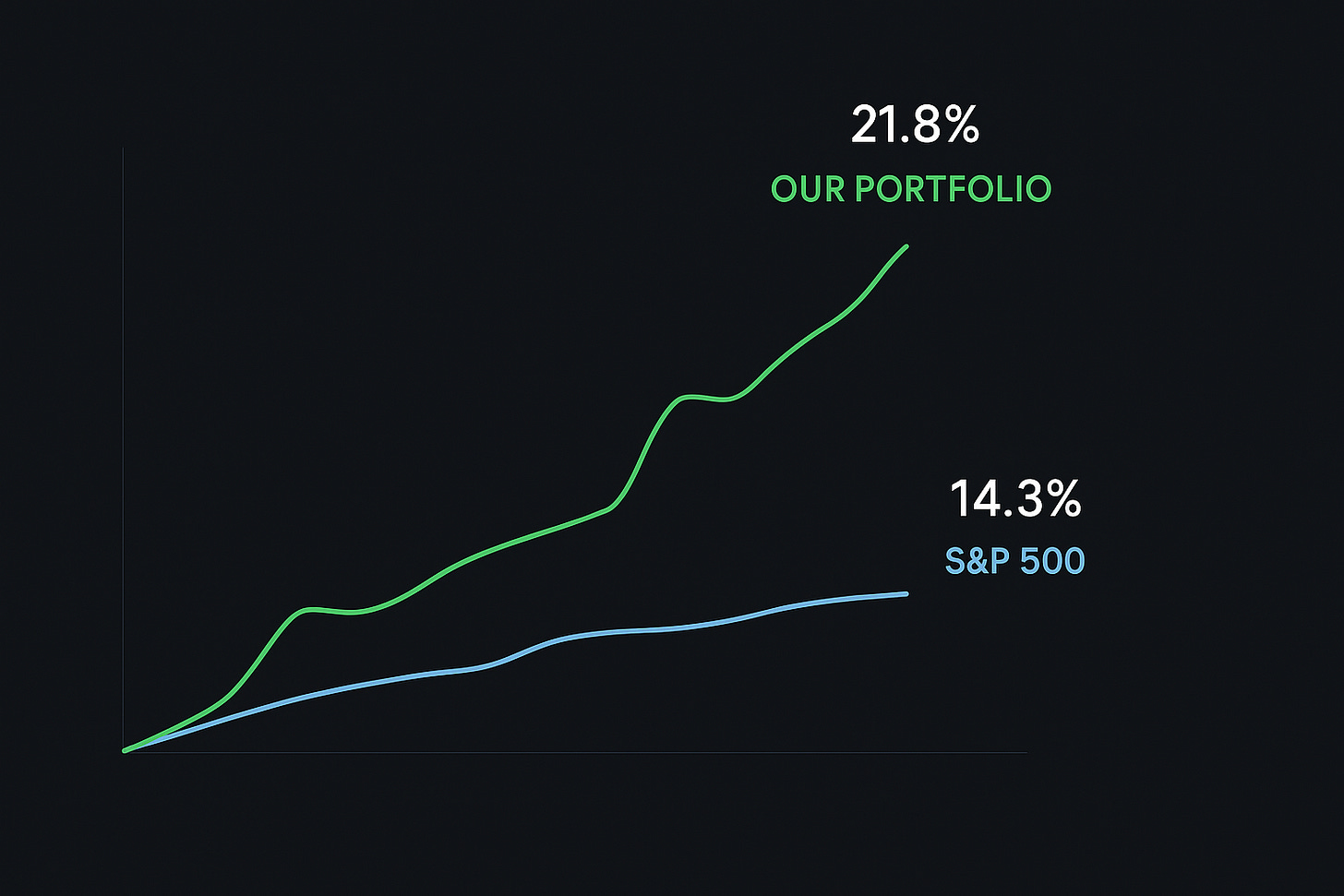

The strategy has worked so far for Compounding Quality:

The only difference is that it will be applied to companies with a market cap below $3 billion.

As Warren Buffett said, the secret to life is weak competition.

If you do your homework for small-cap quality stocks, the upside potential is tremendous:

Identifying these types of companies is a lot of work.

Honestly, it’s been keeping me up at night… but in the best way possible.

Whenever I discover a new, small, high-quality company, I get so excited I just can’t fall asleep.

It’s like what Warren Buffett said amid the Financial Crisis: “I feel like an oversexed man in a harem.”

To give you an example, next week I’m travelling to Hamburg to physically meet Jan Mohr, the CEO of Chapters Group.

Chapters Group is like a mini Constellation Software. The stock is up over 2,000% since its IPO in 2012.

As a way to prepare, I already wrote a 41-page Deep Dive on the company:

I am truly looking forward to updating all Partners of Tiny Titans about all my findings.

You are amazing

598.

That’s the number of emails I received from amazing Partners giving feedback on Tiny Titans.

Here are some that stood out this week:

One small favor

Currently, I’m in doubt about how many people we should allow at Tiny Titans.

Should it be 100? 200? Or 300?

It’s hard to figure out, and we will only know the correct answer after the launch.

The last thing I want is for us to influence the stock prices too much, making the investment ideas of Tiny Titans uninvestable.

But I also don’t want only 2% of the people interested in Tiny Titans to be able to take a subscription at the start.

For instance, if we limit access to just 100 people, that’s less than 0.01% of our total readership. At the launch of Compounding Quality, over 1,000 people became Partner, and since then, the community has tripled in size.

The price of Tiny Titans will be $1,500/year for Partners of the first hour.

I think this is a steal as similar services usually offer it for $5,000/year (and the price for Tiny Titans will evolve to this level too).

Are you already sure that you want to join the team?

Leave your email here, and you will get the launch email one hour before everyone else:

Please note that the above is only available for existing Partners of Compounding Quality.

Everything In Life Compounds

Pieter

PS Make sure you don’t miss the launch on the 16th of September. Put the launch of Tiny Titans in your calendar here.

It is not the amount of subscribers that plays a role here I think; 100, 2 or 300, it is the amount of capital the suscribers will invest based on the information that will be of influence. From what number of subscribers on will the value of the information seem less valuable than the subscription fee? Will 100 or 300 make a difference to me? At first glance I would say no influence.

Is the report on Chapters available to read or is it just a draft.

I do not find a link to it.

Thanks. Mark