Mini Buffett Stocks

Hi Early Mover 👋

Warren Buffett is the best investor in the world.

The main advantage we have over him? We can invest in small companies.

Let’s dive into a list of 500 Mini-Buffett stocks. Can we find a next Berkshire Hathaway?

A Mini-Buffett stock is a High-Quality SmallCap Stock where insiders still own a significant stake. They have the potential to become multibaggers over time.The Power of Incentives

I already learned the power of incentives as a child.

In middle school, my math teacher gave us extra assignments.

They didn’t count for our grade. She said they were “for our own good.”

Like most students, I ignored them.

Then one day, she gave us a surprise. Our next assignment would be half our grade.

Suddenly, every student, including me, was all ears, hanging onto her every word.

When something mattered to me, I cared. And I believe others work the same way.

That’s how incentives work. Whether in school or business, people focus on what benefits them directly.

The same is true on the stock market.

And that’s exactly why I love Owner-Operator Stocks so much.

If management has made a significant investment in its own company, you know incentives are aligned.

These Owner-Operators will do everything they possibly can to maximize shareholder value.

Mini-Buffett Stocks

If Warren Buffett were managing a smaller Portfolio and had more flexibility, what stocks would he buy today?

That’s the question I asked myself.

The answer? A list of what I call ‘Mini-Buffett Stocks’.

Let’s start with every US-listed stock and trim them down using the same criteria Buffett himself would use:

High Insider Ownership: Management should have real skin in the game

Small Caps: The kind of stocks that move the needle for regular investors, but not for a one trillion empire

Quality: Profitable businesses with excellent capital allocation

This is how Buffett made his fortune before Berkshire Hathaway became too big to play in the Small Cap sandbox.

Let’s start with..

Companies with high Insider Ownership

You know by now that incentives matter.

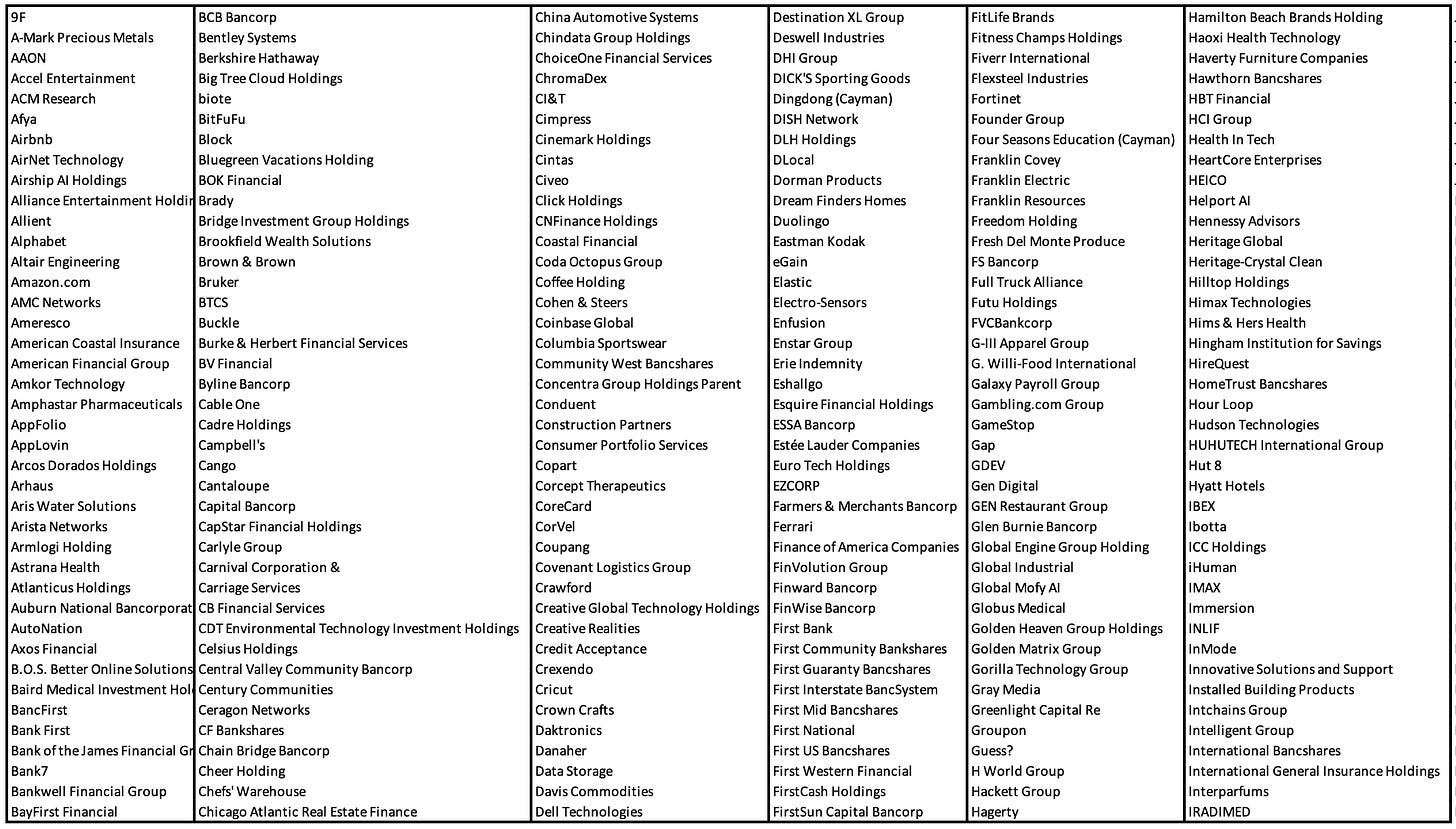

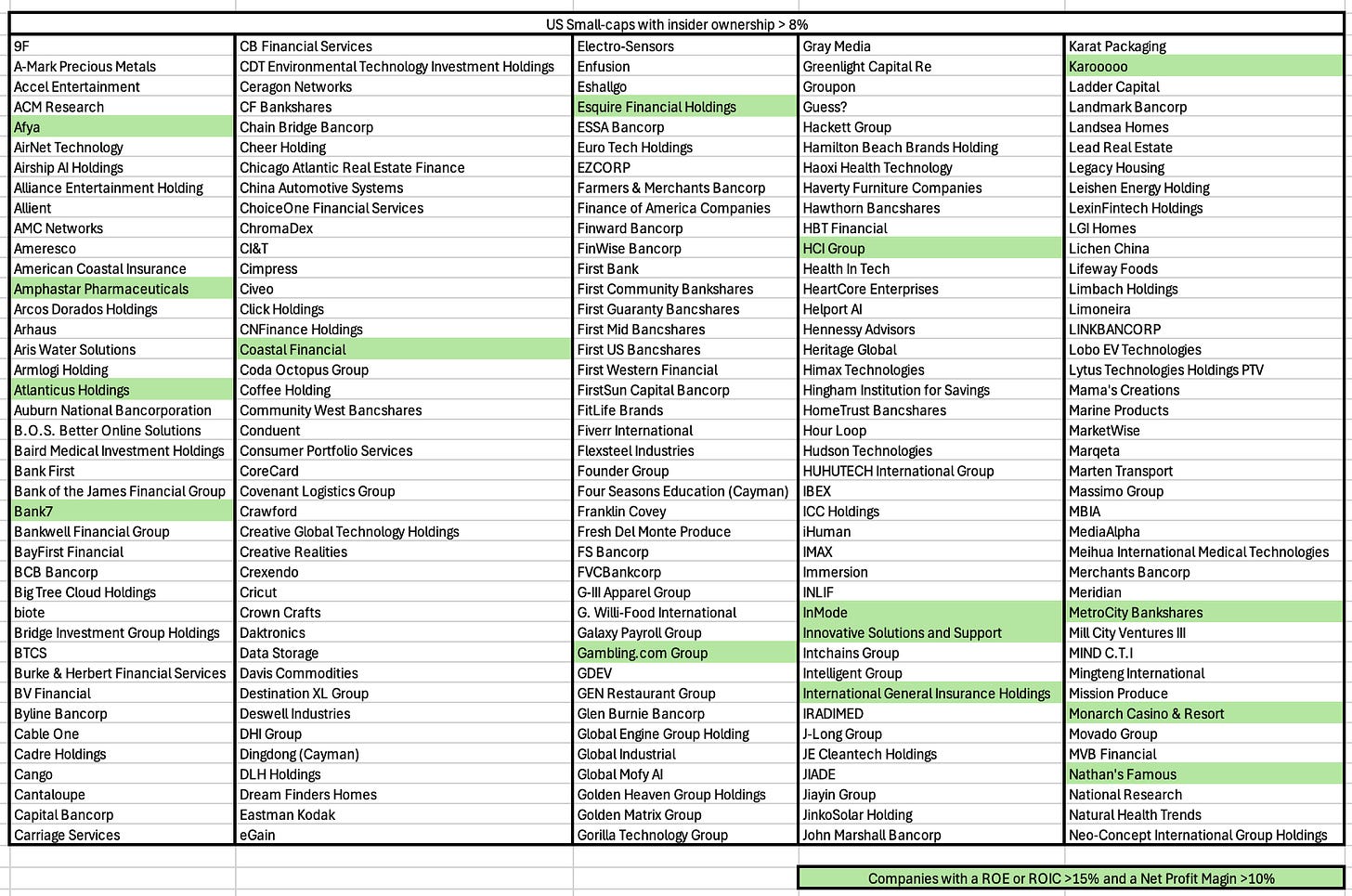

That’s why I compiled a list of US traded stocks where insiders own at least 8% of total shares outstanding.

This way, incentives are aligned. If the stock doesn’t perform, managers will do badly as well.

What I found? Out of around 8,000 securities on U.S. stock exchanges, 512 companies have sufficient insider ownership.

Here’s the entire list:

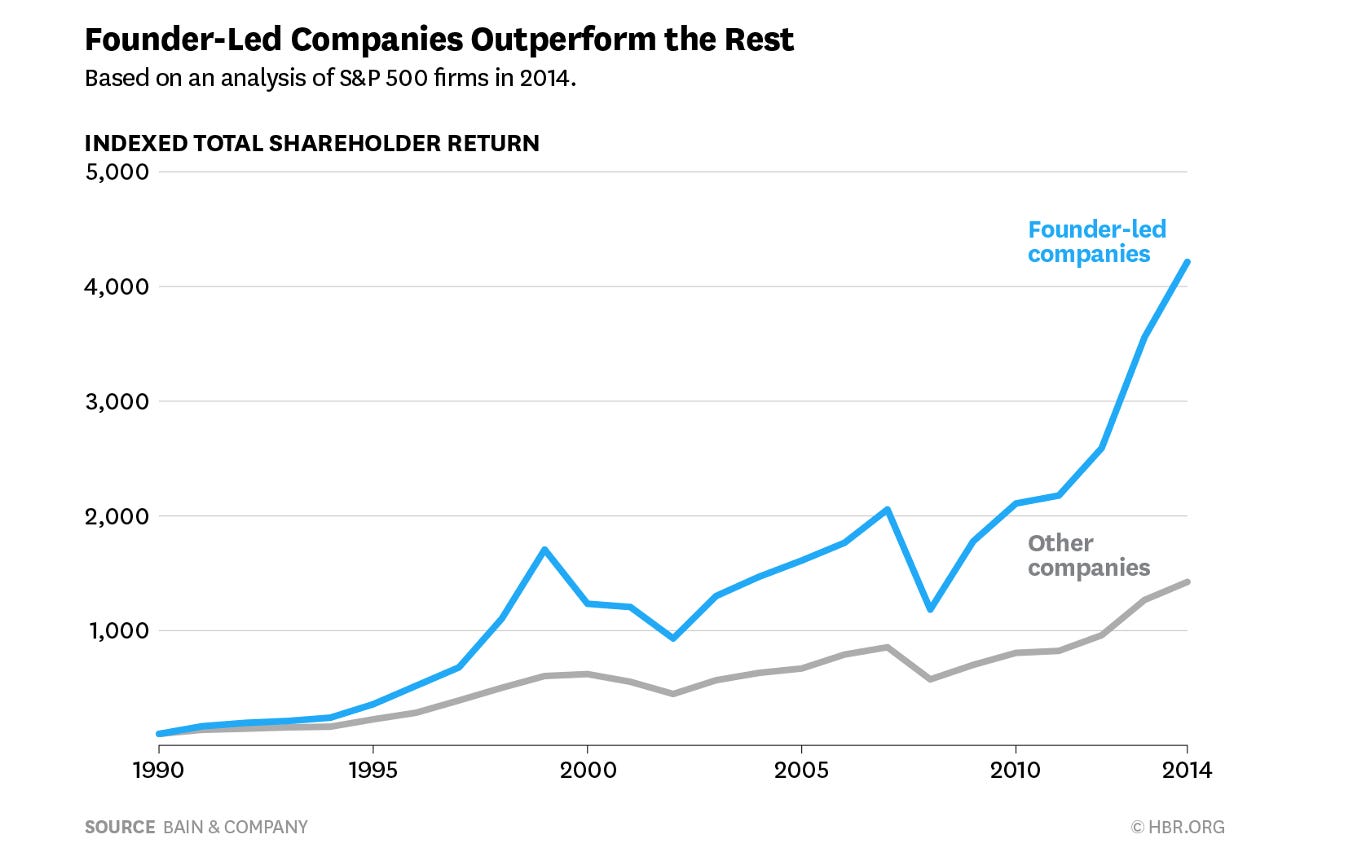

I would be comfortable stating that this list outperforms the market in the long term.

But let’s take it one step further.

We want to filter out the stocks that have too much competition.

When lots of people look at a stock, there are often less chances for big gains.

That’s why we’re zooming in on…

"To succeed in investing, go where competition is weak." - Warren BuffettSmall Caps

Mini-Buffett Stocks are Small Cap Quality companies most investors ignore.

Buffett himself can’t invest in these smaller companies due to the law of large numbers.

"Everyone who says that size doesn't hurt performance is selling." - Warren Buffett.We still can.

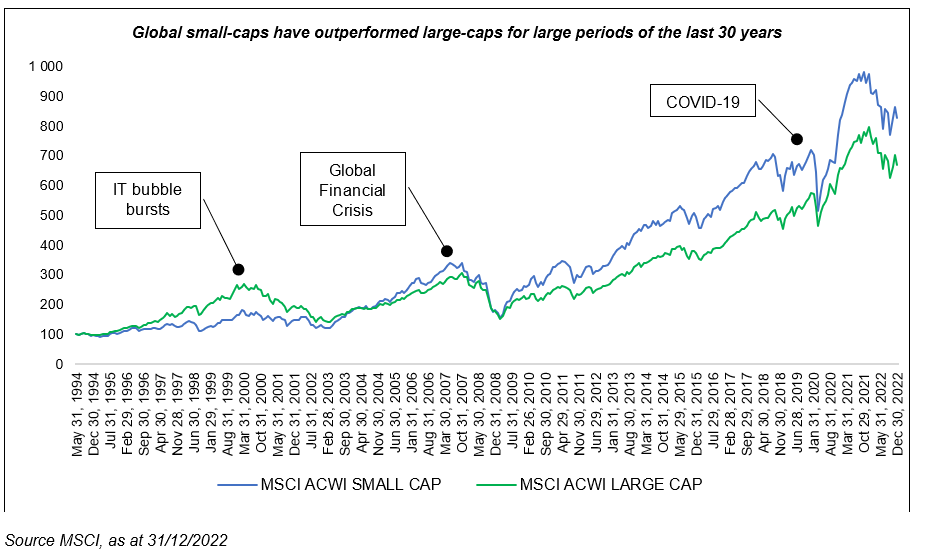

The beautiful thing? Small Cap stocks outperform large caps by 3.4% over time.

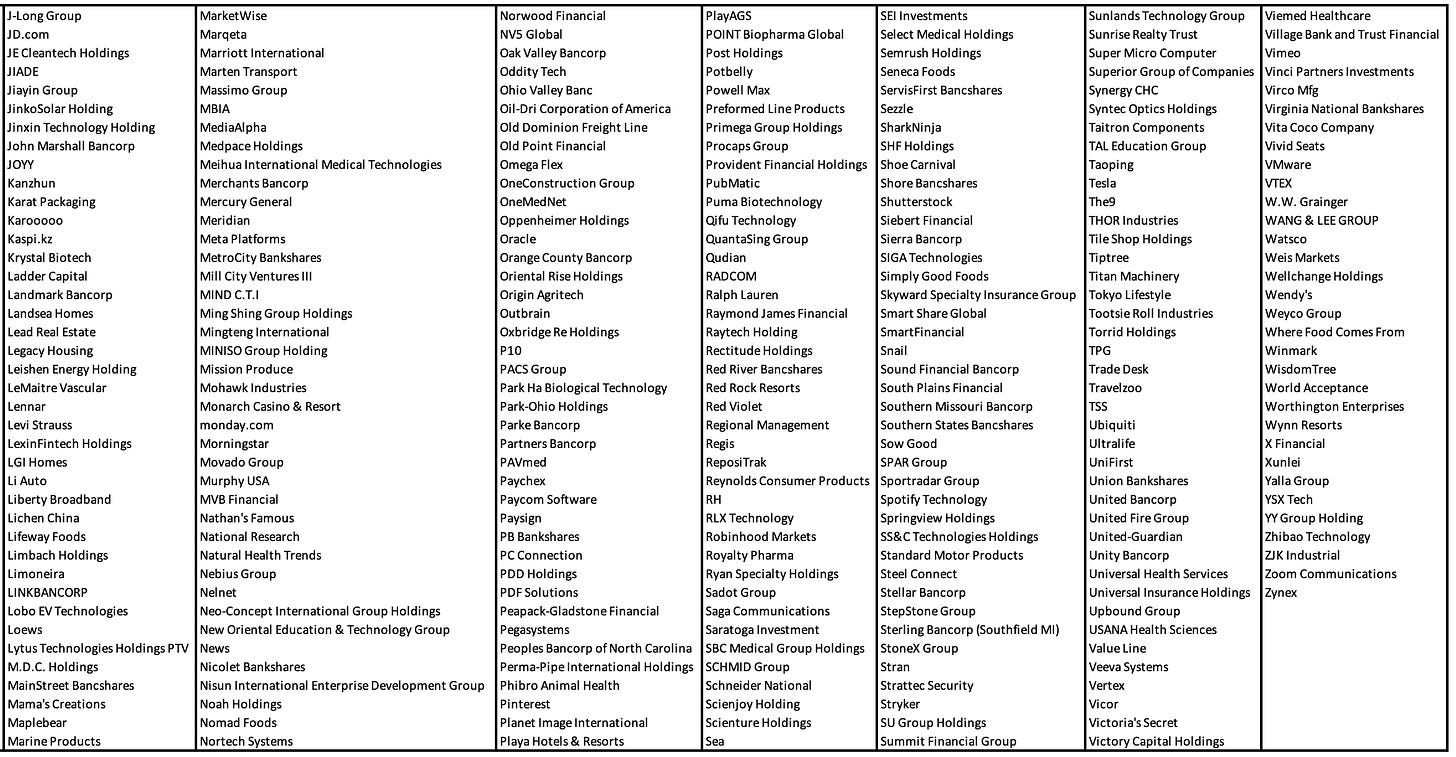

When we exclude all large caps (Market Cap > $2 billion) from our list, we end up with 323 Small Caps with high insider ownership.

But let’s take it even further.

Quality

Warren Buffett only wants to invest in the best of the best.

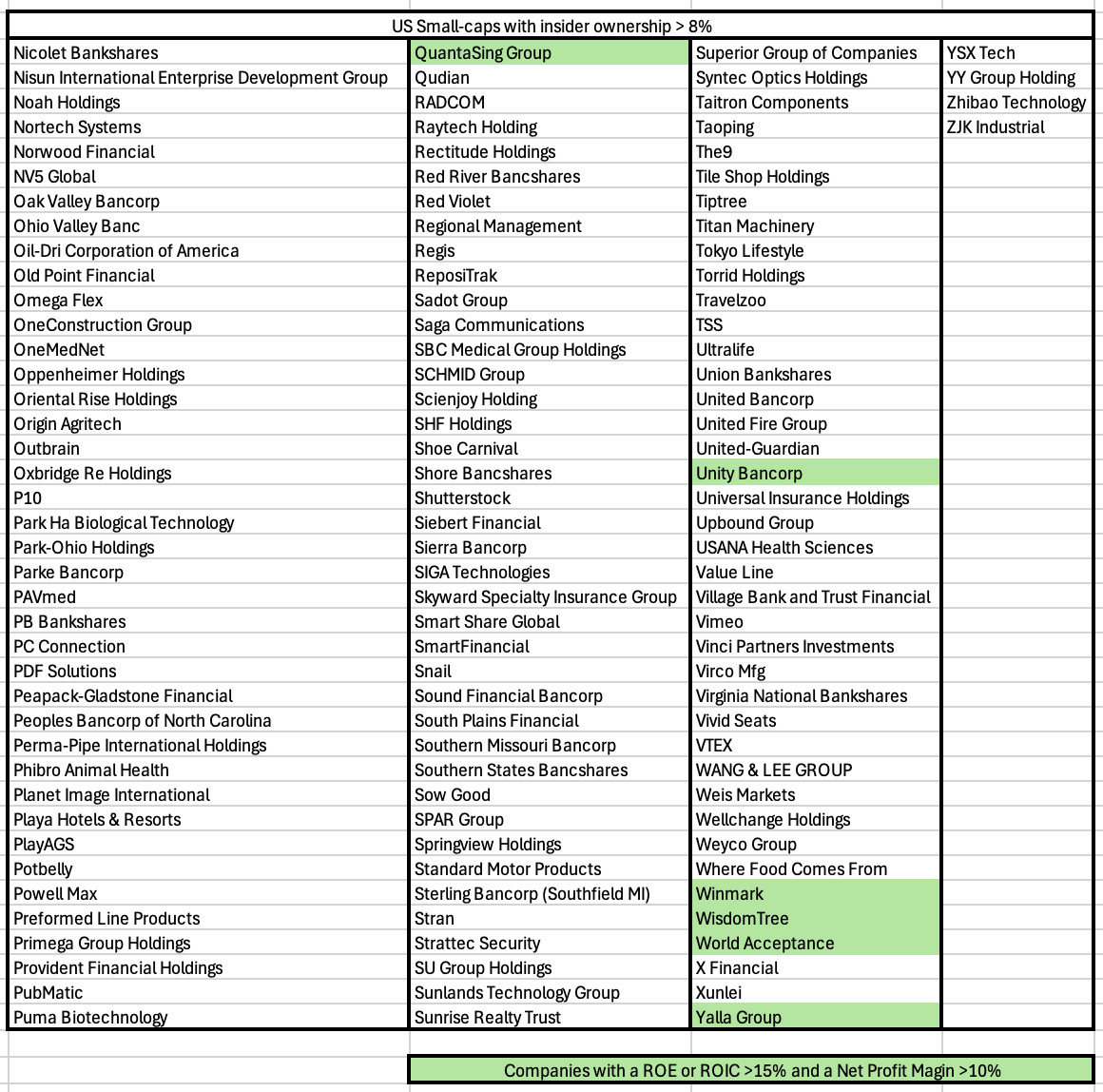

I’m continuing to trim down the list on some Quality Criteria:

Great capital allocation skills: ROE or ROIC > 15%

High profitability: Net Profit Margin > 10%

Let’s dive into the full list and show you my five favorite ones.

Here’s the list with 323 Small Cap Stocks with high Insider Ownership.

I highlighted the companies that fit my Quality Criteria:

Out of this list, let’s highlight 5 intersting companies.

Our 5 Favorite Mini-Buffett Stocks

5. Winmark ($WINA)

Winmark specializes in franchising resale stores.

The company helps people buy and sell used clothes, sports gear, and music equipment.

They own brands like Plato’s Closet, Play It Again Sports, and Music Go Round. These stores buy used items from customers and then sell them at lower prices than new ones.

This helps people save money while also recycling things instead of throwing them away.

Investment rationale

Incredible capital allocation (ROIC: 206.4%)

Winmark converts 51% of its Revenue into Free Cash Flow

Insider ownership: 17.2%

4. Monarch Casino & Resort ($MCRI)

Monarch Casino & Resort runs high-end casinos and luxury hotels in Reno, Nevada, and Black Hawk, Colorado.

These places aren’t just about gambling, though they have plenty of that. Slots, poker tables, blackjack, you name it.

But here’s the real game: Hospitality. Monarch makes money not just from bets on the table but from everything around them. Fancy hotel rooms, steakhouses, spas, etc.

It’s a business model as old as Las Vegas itself. Keep people comfortable, entertained, and spending. Monarch has mastered that formula.

Investment rationale

The house always wins (if you’re playing long enough, you always lose when you gamble)

Healthy balance sheet (small Net Cash Position)

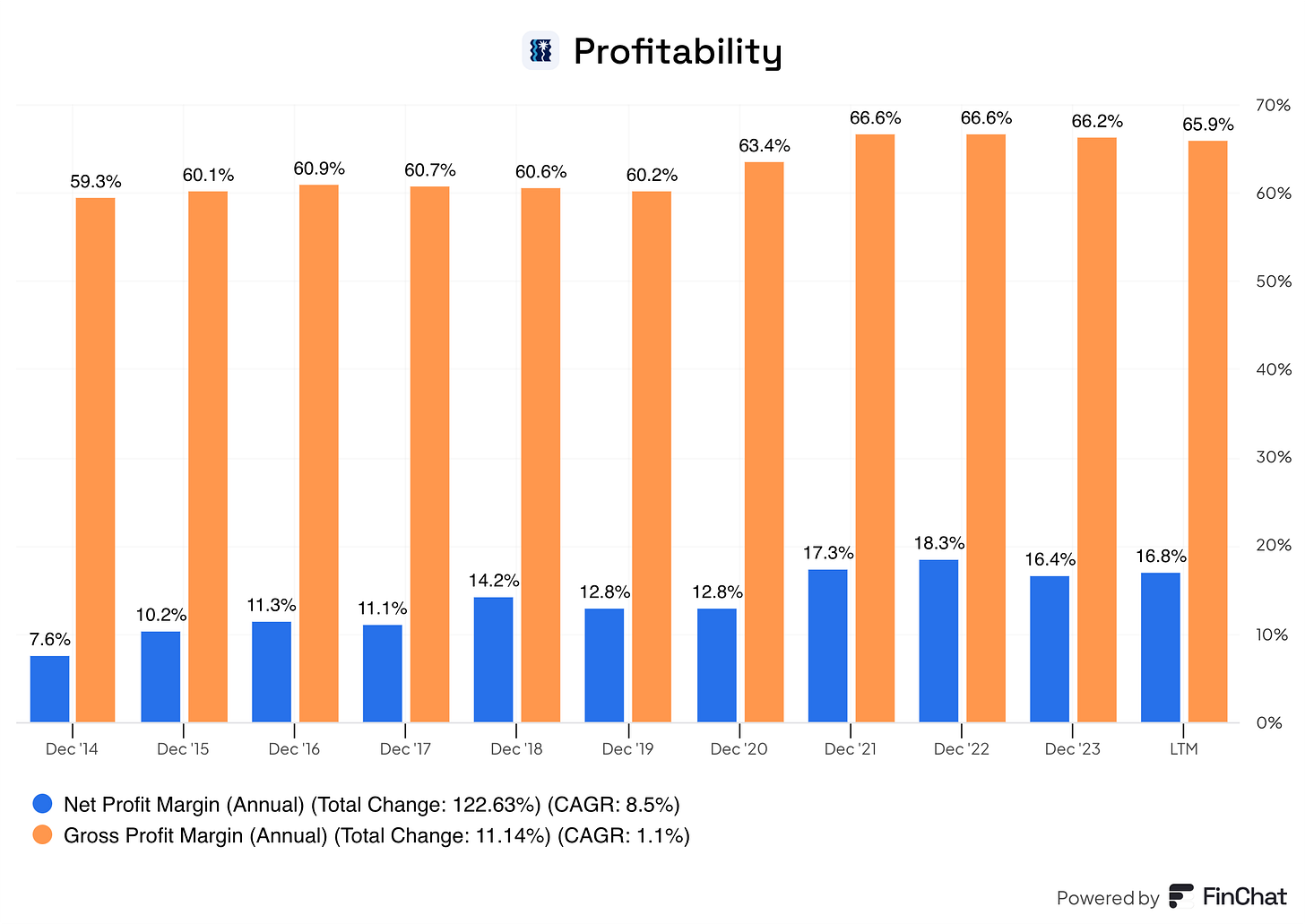

The company is very profitable (Gross Margin: 65.9%)

Now let’s dive into the top 3.

Can we find some potential multibaggers?

3. WisdomTree ($WT)

WisdomTree is a company that helps people invest their money, especially in ETFs (Exchange-Traded Funds).

ETFs are like baskets of different stocks or bonds that you can buy all at once. This makes it easier to invest without picking individual companies.

WisdomTree creates and manages these ETFs to focus on smart strategies to help investors grow their money.

Compounding Quality has an ETF of WisdomTree in the ETF Portfolio as well.

Investment rationale

For every $100 in Revenue, WisdomTree generates $26 in Free Cash Flow

Insiders own 9.3% of total shares outstanding

Secular trend: ETFs are gaining popularity

2. Unity Bancorp ($UNTY)

Unity Bancorp is a bank that lends money to businesses and individuals.

Like all banks, Unity makes money on the spread:

Spread = Interest Rate on Loans − Interest Rate on Deposits

It’s based in New Jersey and focuses on local customers. That means it knows its market well.

And when a bank understands its customers, it can lend wisely and profitably.

It’s not the flashiest bank. But that’s exactly what makes it so interesting.

Because in banking, consistency is everything.

Investment rationale

Buffett is a huge fan of investing in banks

Unity Bancorp has a healthy balance sheet

The company has a history of rewarding investors:

1. Nathan’s Famous ($NATH)

Nathan’s Famous is behind the iconic hot dogs you see at ballparks, grocery stores, and street stands.

They started as a small hot dog stand in Coney Island, New York, over 100 years ago.

Now, they sell hot dogs, fries, and other fast-food snacks across the U.S. and even globally.

And every Fourth of July, they host the world’s biggest Hot Dog Eating Contest! The world record? Joey Chestnut with 76 (!) hot dogs in 10 minutes.

The company makes money from restaurants, food stands, and selling their products in stores. It’s all about classic American comfort food.

Investment rationale

Phenomenal capital allocation (ROIC: 159.7%)

Moat based on a strong brand name

Insiders own 30.7% of the company

Join the community

You aren’t part of the Community yet?

In this Community, there are daily discussions about stock ideas, updates on the companies we own, and much more.

You can join here:

Book

Order your copy of The Art of Quality Investing here

Used sources

Interactive Brokers: Portfolio data and executing all transactions

Finchat: Financial data

Just had a Quick Look at Nathan’s Famous. They seem to have negative equity. Seems so strange to me. For me, this would normally be a red flag. Thoughts ?

Lots of thoughts are going through my head! 😊

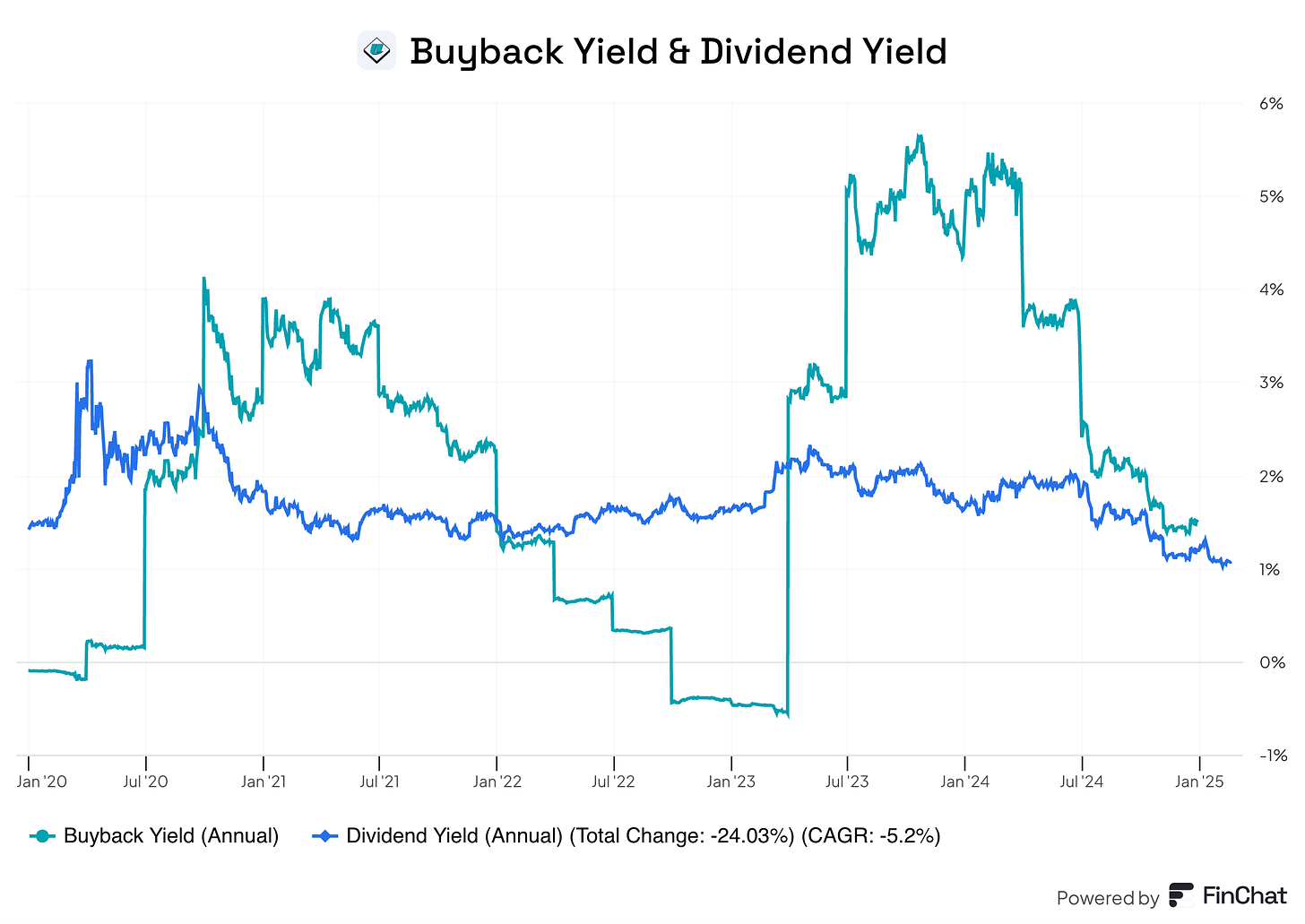

When a company is small and growing, we expect it to invest as much of its cash back into itself. The last action I would expect is a dividend payment. Looking at $MCRI, I see they are paying a $0.30/share dividend. Has the company reached their desired level of maturity?

Would it be fair to say some small cap companies want to remain being small cap companies?