What Buffett Would Buy With $1 Million

Hi Early Mover 👋

One of the problems Warren Buffett is facing nowadays?

The large size of Berkshire Hathaway.

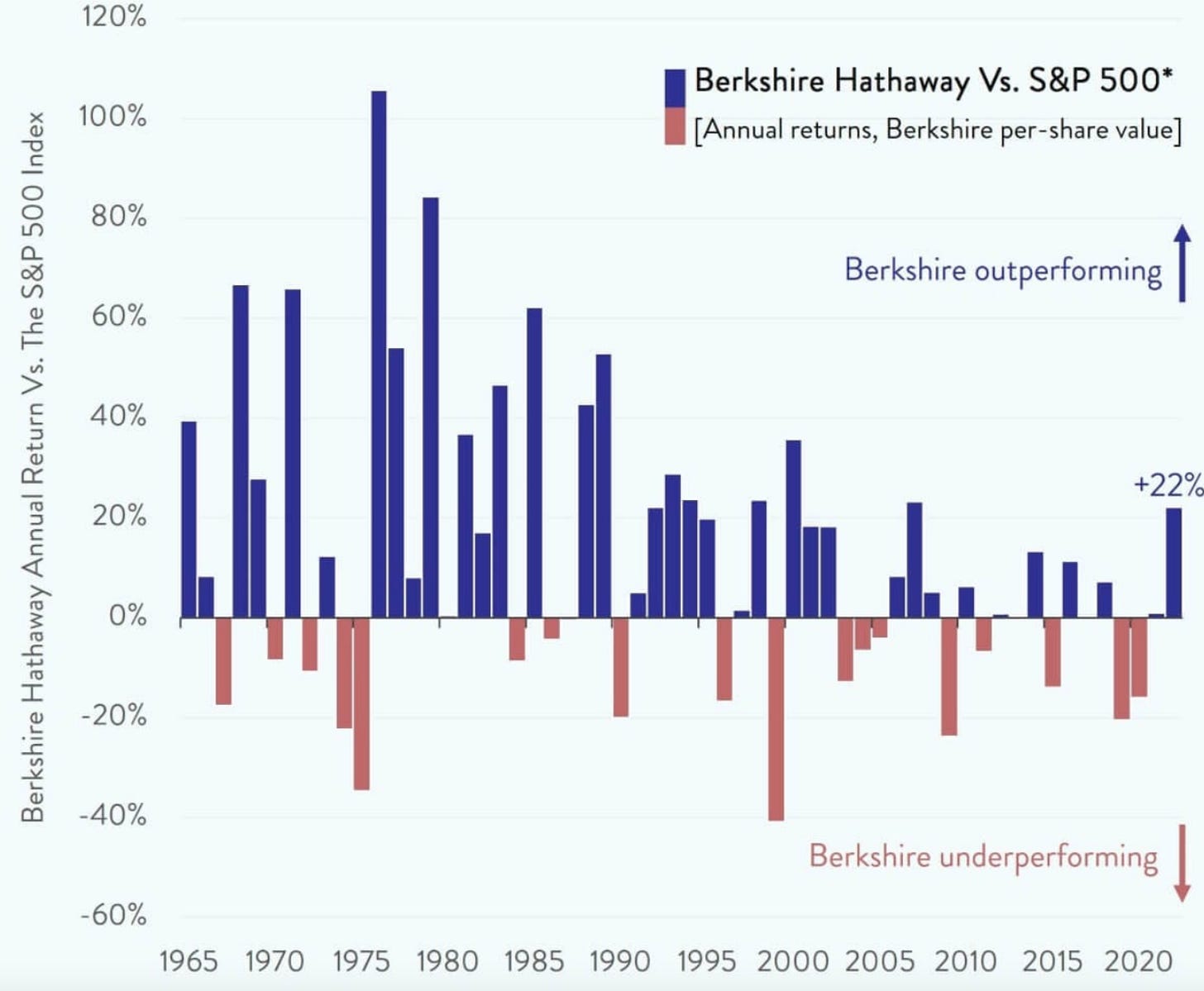

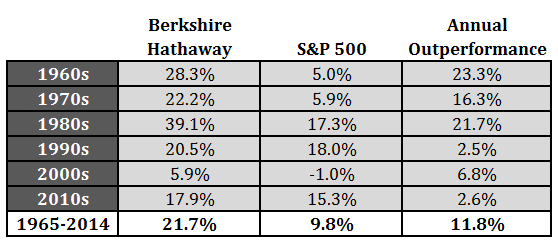

It’s the main reason for Buffett’s declining outperformance:

Buffett’s biggest limitation

Despite all his success, Warren Buffett remains remarkably humble.

Just look at his house.

It’s a wonderful place, but for a man worth over $150 billion? It’s probably the most modest house ever.

A fun fact: Warren bought his house in 1958 for $31,500 and called it one of his best investments.

Or take his car: a 2014 Cadillac.

Not exactly what you’d expect from one of the richest people on Earth.

But one time, Buffett said something that wasn’t humble at all.

He said something you’d rather expect to hear from a naive teenager investor who thinks he cracked the code.

Here’s what he said:

“If I were running a small portfolio — say, a million dollars — I could make 50% a year. I know I could. I guarantee that” - Warren BuffettAnd honestly? I believe he is right. Let me explain why.

It’s very easy: size hurts performance.

In his 2023 shareholder letter, Warren wrote:

"There remain only a handful of companies in this country capable of truly moving the needle at Berkshire, and they have been endlessly picked over by us and by others. Some we can value, some we can’t. And, if we can, they have to be attractively priced. Outside the U.S., there are essentially no candidates that are meaningful options for capital deployment at Berkshire. All in all, we have no possibility of eye-popping performance."It seems like Buffett is going against his own words.

On the one hand, he claims he could earn 50% annual returns if he was running a small portfolio.

On the other hand, Warren admits there’s no chance for “eye-popping performance” at Berkshire.

But it makes perfect sense. And it all comes down to one thing: size.

Berkshire has grown so large that Buffett simply can’t invest in the businesses that once delivered his highest returns.

This has created a clear pattern over time: The bigger Berkshire got, the smaller the outperformance became.

Buffett currently has $350 billion in cash.

Do you really think buying the next GEICO or See’s Candy would move the needle for him? I don’t think so.

Small Caps

Our main advantage over Warren Buffett? We can still invest in small businesses.

And guess what? Small businesses can be excellent investments.

There are several reasons for this.

Low valuation levels

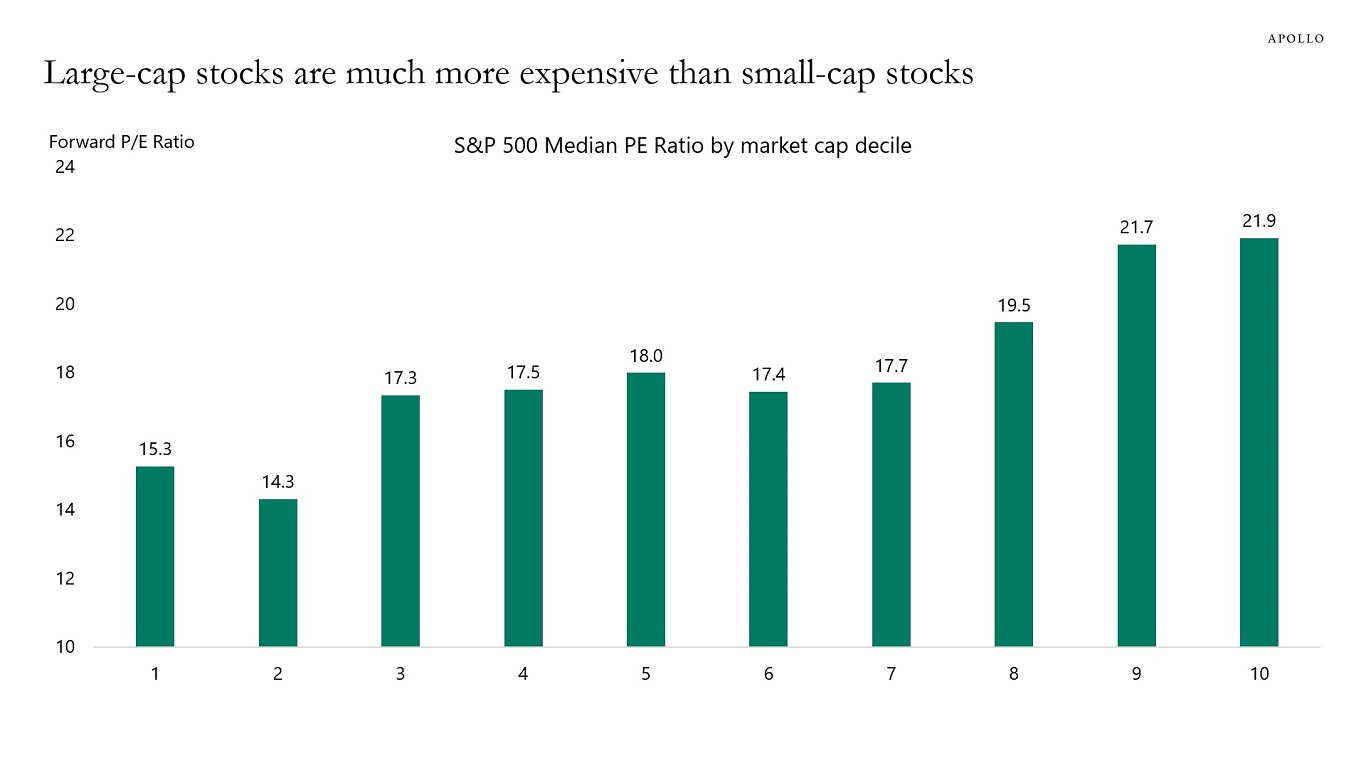

First, small-cap stocks typically trade at lower valuation levels than large-cap stocks.

That’s because professional investors can’t invest in small caps.

A few years ago, I was responsible for the daily operations of a fund with $200 million in Assets Under Management (AUM).

While that might sound like a lot, it’s peanuts in the broader financial world.

But even our ‘small’ fund couldn’t invest in stocks with a market cap under $10 billion.

This is a common limitation for funds, which means small caps are underfollowed.

As a rule of thumb, the smaller the stock, the less efficient the market.

That’s why investing in small caps can be very interesting for investors like you and me.

"The secret of life is weak competition. If you want to outperform the market, go where competition is weak." - Warren BuffettThe law of large numbers

The law of large numbers states that the larger you get, the harder it is to grow at very high rates.

It’s way easier for a company that earns $1 million to double in size compared to a company that earns $50 billion.

Let’s take Apple ($AAPL) as an example.

If Apple were to grow at a CAGR of 10% for the next 20 years, it would be worth roughly $20 trillion (current market cap: $3 trillion).

In other words, Apple would be worth more than the entire economy of France, the UK, Japan, and India combined.

That’s the challenge of scale: the bigger you are, the harder it becomes to grow.

Small caps don’t have this constraint.

"Anyone who says size doesn't hurt performance is selling." - Warren BuffettHistorical proof

Still not convinced? Then look at the historical performance.

Between 1926 and 2006, the smallest decile stocks compounded at a CAGR of 14.0% compared to 10.3% for the S&P 500.

We see the same trend in Our Portfolio. Our smallest business, Kelly Partners Group ($KPG), has produced the strongest returns.

Why did we pass on a perfect stock?

Unfortunately, at Compounding Quality, we’re starting to face the same challenge.

We’re getting too big.

As a result, we’re moving the stock prices of small businesses too much.

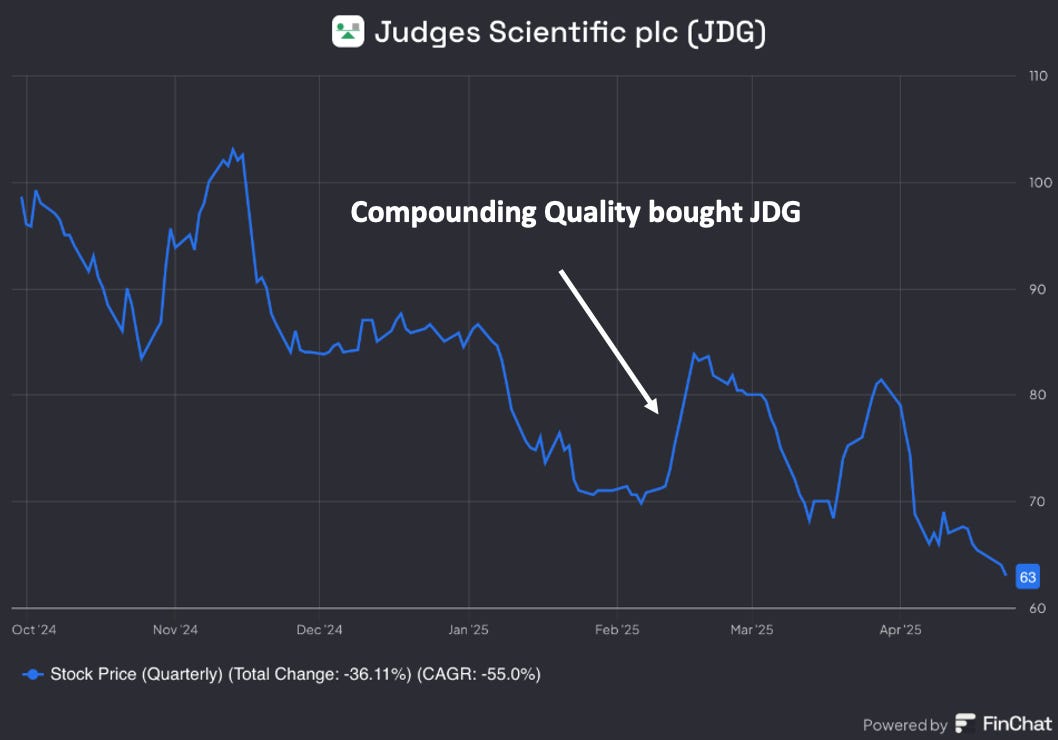

Just look at Judges Scientific ($JDG).

After the day we announced we were buying the stock, it jumped 10% intraday.

I was also seriously considering adding Sanlorenzo ($SL) to Our Portfolio. It’s a high-quality business and checks a lot of boxes.

But in the end, I decided not to.

Why? Because we would have an impact on the stock price.

It’s a pity we can’t invest in these overlooked, high-quality mini compounders anymore.

Hopefully we can shortly via Tiny Titans.

Everything In Life Compounds

Pieter

One other thing to consider: the best businesses are usually also the biggest. For example: if you would list the 100 best businesses in the world in terms of moat and business quality, i would guess that 90% of these would be large caps already. So , while high quality small caps would generally outperform, the “hit rate” of a great smallcap amongst 1000s is usually lower than in mid-caps and large-caps. Anyway, happy hunting!

Berkshire may be bumping into a newly discovered maximum limit of "acquisitional" growth. A few people at work know that I invest and they half jokingly say that Berkshire should buy our company, Baker Hughes. The market cap for Baker Hughes is only ~$40 billion.

On the one hand, it's not big enough to make dent in Berkshire's cash pile and even a 20% return on it would be only $8 billion. If the $40 billion didn't dent the cash pile at Berkshire then what effect will $8 billion have? Nothing.

On the other hand, Baker Hughes is too big for itself as well if it wanted some kind of outperformance. At $4 billion Baker Hughes would grow like weed but at $40 billion it will plod along.

Berkshire would have to buy something really, really, really big that would change the way people all over the world live their lives. Warren mentioned how Berkshire could step in should America decide to build something like the interstate highway system but needed a partner. This probably would have resulted in semi-privatized roads (maybe?) and the returns over a long period of time would have been huge. Maybe Berkshire is waiting for something like this in energy?

That ... or Berkshire would have to buy a country and run it like a business, which would be impossible to do.