My Tiny Titan Stock Screener

The Next LeMaitre Vascular?

Welcome to the 8th edition of my exclusive Tiny Titans behind-the-scenes newsletter.

Last week, you learned how I found a 100-bagger thanks to Warren Buffett.

Today, I’ll explain how I screen for Tiny Titans.

Make sure you don't miss it. Put the launch of Tiny Titans (16 September) in your calendar here.Since I started sending this behind-the-scenes newsletter, I’ve received 934 emails.

What can I say? I feel sincere gratitude.

Your emails are invaluable. It’s helping Tiny Titans get even better.

This week, I’ll discuss how I identify Tiny Titans stocks.

How to find Tiny Titans

I am already quite far in building the finalized watchlist for Tiny Titans.

Currently, there are 95 companies with 10x potential on the list.

But let me explain to you how I did my first screening initially.

I look for companies with the following characteristics:

Market cap < $3 billion (small companies outperform)

Net Debt / EBITDA < 3 (healthy balance sheet)

No extra shares issued in the past 3 years (we don’t like dilution)

Net Profit Margin > 10% (high profitability)

ROIC > 15% (great capital allocation skills)

5-year average Revenue growth > 9% per year (attractive growth)

5-year average EPS growth > 11% per year (attractive growth)

Over 250 companies match these criteria.

We will use it as a starting base for our research.

Here are the 30 US companies that match these criteria:

The Vita Coco Company

I want to briefly highlight The Vita Coco Company.

It’s a very boring company. They make and sell coconut water and other healthy drinks.

“Investing should be more like watching paint dry or watching grass grow. If you want excitement, take $800 and go to Las Vegas.” – Paul SamuelsonInsiders still own 10% of the company, and it’s a very profitable business.

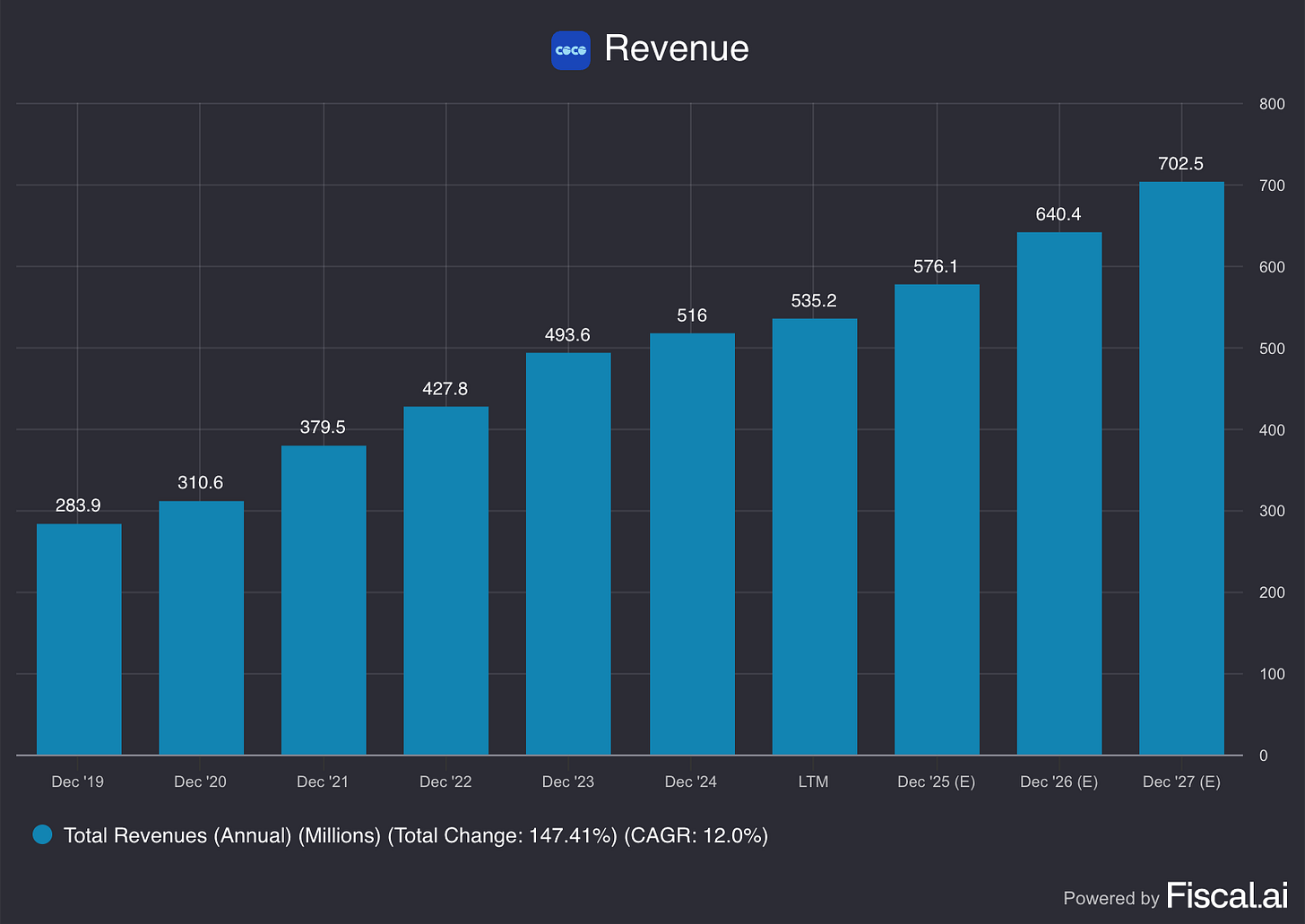

The Vita Coco Company has grown its net income from $283.9 million in 2019 to $535.2 million today.

Those are exactly the kind of companies we want.

Why? In the long term, stock prices always follow the evolution of the intrinsic value.

It should be no surprise that the stock increased by 120% since its IPO in 2021.

LeMaitre Vascular

Another phenomenal company? LeMaitre Vascular.

The company makes money by selling medical products that help doctors treat blood vessel problems.

George Lemaitre, the chairman and CEO, still owns 8% of the company.

He has proven to be an amazing capital allocator.

The stock is up +1,600% since 2005.

I am quite sure that Tiny Titans will have plenty of success stories like The Vita Coco Company and LeMaitre Vascular.

I’ve already identified 3 stocks that will be bought on Day 1 (16 September).

Please note that I will invest REAL money in these companies.

This way, our incentives are aligned.

As The Pointer Sisters sing: “I'm so excited! And I just can't hide it.”

I hope you are ready as well!

Today’s Action Item

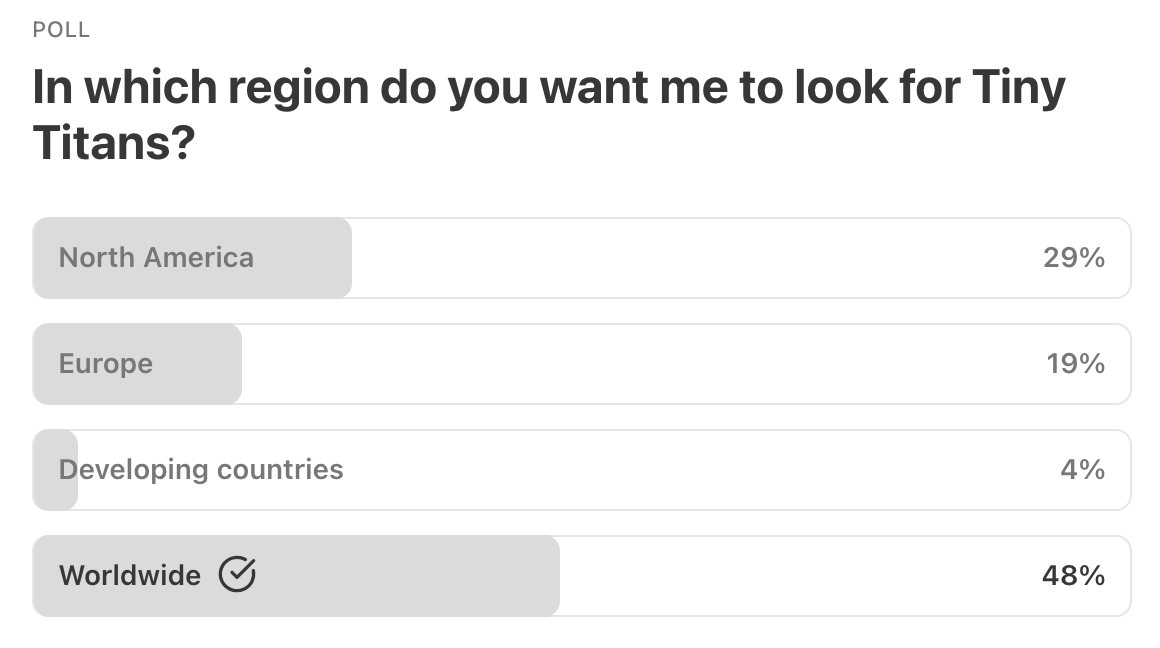

Last week, I asked you which stocks you prefer me to cover for Tiny Titans.

Here are the results:

As you decided, Tiny Titans will cover stocks worldwide.

Here’s the question for this week:

Finally, here’s an email I received last week:

Talk to you next week!

Everything In Life Compounds

Pieter

P.S. Tiny Titans will launch on the 16th of September. Don’t forget to put it in your calendar here.

P.P.S. Are you already sure that you will join? Leave your email here and receive the invitation on the 16th of September, one hour in advance.

You are amazing! I have been in markets for 25 years and will admit that I love your approach and discipline. Kudos to you

I agree completely. Excellent decision to be a subscriber of Compounding Quality.