🍏 Some kind of fruit company

Welcome to the 9th edition of my exclusive Tiny Titans behind-the-scenes newsletter.

Last week, you learned about My Tiny Titan Stock Screener.

Today, I’ll give an insight in Our Portfolio.

Make sure you don't miss it. Put the launch of Tiny Titans (16 September) in your calendar here.Have you ever seen the movie Forrest Gump?

In the movie, Forrest earned a lot of money from his shrimp business, Bubba Gump Shrimp Co.

It became a huge success after a hurricane wiped out all his competitors, and his boat was the only one left fishing.

It gave him a monopoly for a while.

Forrest gave half the money to Bubba’s family, as he promised.

With the other half, his business partner and financial advisor, Lieutenant Dan, invested in ‘some kind of fruit company’.

The ‘fruit’ company he invested in? Apple.

Forrest Gump invested $65,000 in Apple in 1994.

If he had kept all his shares until today, his stake would be worth over $50 million.

I would love to have invested in Apple in 1994.

The goal is to find similar companies for Tiny Titans.

I want Tiny Titans to be the best and most profitable newsletter you’ve ever read.

The goal? Find companies with 10x potential.

There are many obvious success stories (returns since 2001):

Microsoft: +2.800%.

Amazon: +52.700%

Apple: +82.000%

But there are also a lot of success stories you might have never heard of:

Intuitive Surgical: +34.000%

Texas Pacific Land Trust: +47.000%

Axon Enterprise: +100,000%

I am 100% convinced that it’s the easiest to find these potential 100-baggers in the small- and mid-cap space.

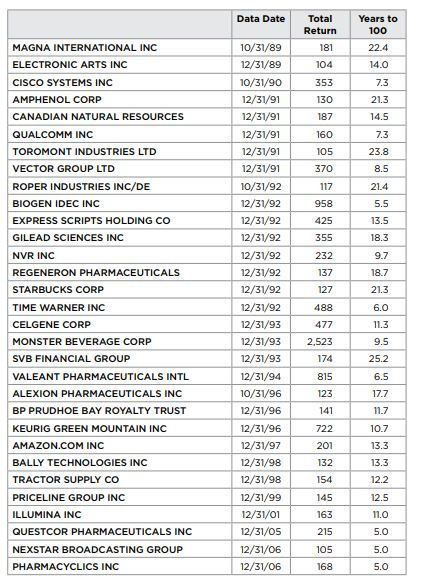

Here are some examples of 100-baggers:

Our Portfolio

The Portfolio of Tiny Titans will consist of 30-35 companies.

Within these names, I expect a few big winners. They will likely drive most of the return.

I am quite comfortable stating that the Tiny Titan Portfolio will outperform the market in the long term.

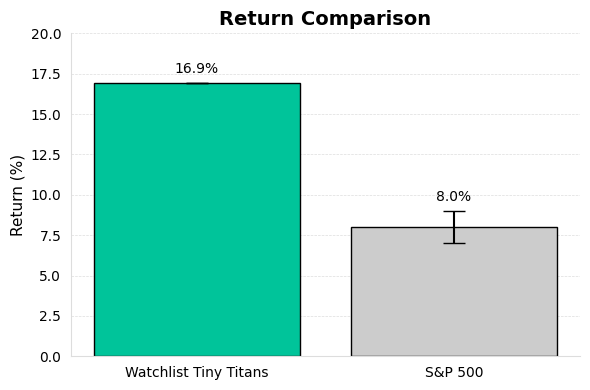

Why? Just take a look at this chart:

If I look at the historical returns of companies in our watchlist, I get the following:

In the very long term, the Tiny Titans watchlist generated a yearly return of 16.9%.

That’s more than twice as good as the S&P 500.

It explains our slogan quite well:

Small Companies. High Quality. Big Potential.

Of course, the goal is to select the companies with the most potential within this watchlist.

A company like Mainstreet Equity. It increased by +7.200% since 1999.

Or a company like Alpha Group. They are up +1.600% since 2017.

Unfortunately, Corpay recently announced it will acquire Alpha Group. The stock is up +30% over the past month as a result.

Alpha Group was a company that would have been included in Tiny Titans.

We just missed this one, but it highlights that we’re on the right track.

Today’s Action Item

Last week, I asked you how much you would invest in Tiny Titans stocks.

Surprisingly, 5% said they will invest more than $500,000.

Quite some capital is represented in this exclusive newsletter.

Here’s this week’s question:

Currently, there are 8.479 people on the waiting list, and there will (probably) be 250 available spots on the Launch Day (the 16th of September).

I truly hope that I can welcome you on the other side soon.

Talk to you next week!

Small Companies. High Quality. Big Potential.

Pieter

P.S. Tiny Titans will launch on the 16th of September. Don’t forget to put it in your calendar here.

P.P.S. Are you already sure that you will join? Leave your email here and receive the ‘open-the-doors’ email 1 hour in advance on the 16th of September.