Welcome to the 6th edition of my exclusive Tiny Titans behind-the-scenes newsletter.

Last week, I helped you determine whether Tiny Titans is something for you.

Today, I’ll explain the difference between Tiny Titans and Compounding Quality.

Make sure you don't miss it. Put the launch of Tiny Titans (16 September) in your calendar here.Hi Partner 👋

Currently, I’m in Hamburg (Germany) to meet Jan Mohr, the CEO of Chapters Group. He’s building ‘the Constellation Software of Europe’. The stock is up over 2.000% since 2012.

I will definitely keep you up to date with my key takeaways. But let’s dive into another important topic today.

Last week, I received a lot of questions like this:

Let me explain it to you step-by-step.

Starting from the 16th of September, there will be three newsletters:

Compounding Quality

Compounding Dividends

Tiny Titans

Which newsletter is best for me?

Have you ever heard me talk about Staying Rich, Living Rich, and Getting Rich?

Getting Rich: Quality stocks with plenty of growth potential

Staying Rich: Established quality stocks that are still growing attractively

Living Rich: Great companies that are paying an attractive dividend

Compounding Quality

Compounding Quality is the main newsletter. It’s my baby. It focuses on buying wonderful companies at a fair price.

Think about companies like Visa and Mastercard.

They beat the market in a consistent way.

Compounding Quality is all about ‘Staying Rich’.

Compounding Dividends

Compounding Dividends focuses on growing your wealth while receiving an attractive dividend so you can retire comfortably.

The goal is to build a Dividend Growth Portfolio that generates more dividend income than your monthly expenses.

Compounding Dividends is all about ‘Living Rich’.

Tiny Titans

Tiny Titans uses the same philosophy as Compounding Quality, but applies this strategy to smaller companies.

The upside of this strategy is higher, but there are also more risks involved. The goal is to find a few stocks that can 10x in the future.

Tiny Titans is all about ‘Getting Rich’.

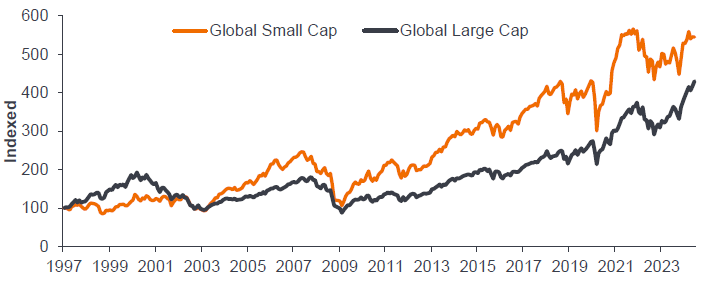

Small caps outperform the market over time:

When you focus exclusively on high-quality companies within the small-cap space, the level of outperformance becomes ridiculous.

Currently, there are 104 companies in our Tiny Titans watchlist.

One example? IES Holdings. The stock is up +1,200% over the past 5 years.

The average 5-year return of all companies in our watchlist equals +333%.

That’s an average annual return of 34.1% per year.

Overlap?

It’s important to highlight that the overlap between Tiny Titans and Compounding Quality will be very limited.

Tiny Titans will contain a lot of names you’ve never heard of.

The goal is to provide you with as much value as I possibly can. My entire heart and soul lie in this.

I’ll also personally invest my own money in these Tiny Titans.

Why? Charlie Munger sums it up quite well:

“I think I've been in the top 5% of my age cohort all my life in understanding the power of incentives, and all my life I've underestimated it.” - Charlie Munger Exclusivity

Why will Tiny Titans be very exclusive?

Because I want to avoid that we influence the stock prices too much. This would make our investment ideas uninvestable.

Here are a few examples:

Last week, I mentioned FitLife Brands, the stock increased by 8.6% as a result:

When I wrote about Computer Modelling Group, the stock increased by 6.1%:

On the announcement of Our Buy of Judges Scientific ($JDG), the stock increased by 10% intraday:

This is something I want to avoid with Tiny Titans.

Only allowing a limited number of people will allow us to generate the largest outperformance.

Today’s Action Item

I am truly overwhelmed by all the responses so far.

Currently, there are 7.898 people on this waiting list and there will only be a few spots available.

Partners have sent me 633 emails about Tiny Titans so far. Here’s just one example:

I have a hard time digesting all the emails, but I am personally getting back to every single one of you.

Why? We are Partners. We are in this together. And your feedback is invaluable.

I am listening to you. I will do everything I possibly can to make the service the best I possibly can.

That’s why I have this small question for you:

Everything In Life Compounds

Pieter

P.S. Tiny Titans will launch on the 16th of September. Don’t forget to put it in your calendar here.

P.P.S. Are you already sure that you will join? Leave your email here and receive the invitation on the 16th of September, one hour in advance.

Seems like the monthly option would probably be "outdated" to the extent some content would be "old news" untill published. Plus would probably create more work for the author to selectively pick topics worth mentioning that are not already yesterday's news till publication. I believe it's to the interest of both parties (readers & author) to go with the more frequent option (weekly) to be "in-the-news" and avoid overthinking what to include on the 40-page magazine.

Hope this makes sense.

Pieter, you mention at the end of the above to leave our email address and receive the invite 1 hour early on 16 Sep.

For those of us who want to subscribe, it would be wonderful if we can just subscribe and pay now (as per the email you included above).

If not, please indicate the time (including time zone) when the "1 hour in advance" email and "normal email" will be sent out. For those of us who are not in the American or European time zones, knowing when the email invitations will be sent is critical if we want to be aware when the email is received.